Improve your financial well being with help and support from Fair Finance.

In this article we want to tell you more about the news we shared in December, about the impact that Covid-19 is having on our clients, particularly the financially vulnerable.

There seems to be a general assumption around that many people are better off during lockdown. According to a study by AA Financial Services during the first lockdown of the pandemic, 85% of UK adults spent less money during lockdown than they normally would. But this data is largely based on people who are able on a regular basis to spend money on non-essential spending such as holidays, eating out, pubs and leisure activities.

Since the early days of the pandemic, Fair Finance has been very aware that Covid-19 has impacted people differently. Many low and moderate income earners have been disproportionately affected by redundancies, school closures and other Covid-related restrictions. And in many cases certain communities have disproportionately borne the brunt of the health impacts.

To help us understand how different groups have fared during the pandemic, we partnered with Shift to explore this question in depth. We talked directly with our clients about their lives, their money and the pandemic.

We are using the key insights from this research to help us continue to improve our services and keep finding better ways to support our clients and their financial wellbeing.

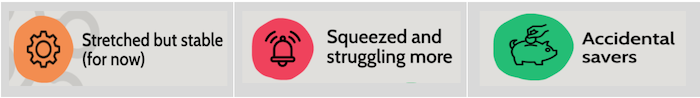

The research revealed some common financial patterns that have occurred during Covid-19and allow us to broadly categorise our clients into three groups who have been impacted differently but also need different types of support:

We will look at each one of these groups in turn. We will explore some of the issues that people in each group are likely to face, and things you can do that may help.

We did this work because we want Fair Finance to be able to support each group in the best way possible through this pandemic and beyond.

Stretched but stable (for now)

This group are those who are financially vulnerable, and are likely to be largely dependent on benefits. If you are in this group, Covid-19 may not have greatly affected your day to day finances, but it has been a major factor in preventing you moving forward with your life. It can be difficult to see a way out of the restricted financial situation you are in, as Covid-19 is limiting the opportunities to find secure, well-paid work and build a better life.

If you are in this situation, here are two things that may help:

- Ensure that you have up to date knowledge of all your benefits entitlements and know how to navigate your way round the benefits system. Our website gives information about where to get financial advice or help with the benefits system.

- Check out our last article Need financial help during Covid-19 which outlines the specific benefits currently available to people impacted by Covid-19.

If you have children, you are likely to have increased your spending during lockdown. There will be higher costs for food and energy because you are all at home more of the time. This is made even more difficult because you may not have the time or opportunity to look around for the best deals, and are not able to spend time with family and friends for moral or practical support.

You may also be under additional pressure because of school closures. Families across the country are increasingly dependent on having reliable devices and internet connection to enable their children to participate fully in online schooling.

The good news is that there is help available for home schooling. All major broadband companies have removed broadband data caps so that children can access online learning without restricted data or increased broadband costs. Many mobile providers have also increased data allowances on their tariffs.

The Department of Education is also providing laptops and tablets for schools. Schools can then make these devices available for disadvantaged children in certain year groups who are either being affected by school closure or have been advised to shield for health reasons. There are also various schemes running - such as BBC Radio’s Give a Laptop - to enable businesses and individuals to donate devices to schools.

If you are struggling with the resources needed for effective home schooling, you need to:

- Speak to your broadband and/or mobile provider to check whether you are benefiting from increased data allowances.

- Contact your children’s school(s), to see if you are entitled to receive a laptop or tablet.

Squeezed and struggling more

The second group identified by the research is people whose finances were already squeezed before the pandemic, but are now struggling even more due to a drop in income . You may already have been on a tight budget, but now find that there are more and more things that you are simply unable to afford.

If you are in this group, you may be faced with either reduced hours at work or losing your job altogether. You may be sliding further into debt and need to apply for benefits support for the very first time.

Fair Finance can help you to find out more about what benefits are available and how to apply for them, as well giving you advice on managing your finances. Start off by checking out these two sources of information:

- Our recent article How to start claiming benefits which provides guidance on the benefits system.

- Details of sources of financial and benefits advice listed on our website.

Also be aware of other sources of help. For example, food banks and fuel banks. We’ll talk more about fuel banks in our next article. Let’s take a closer look now at food banks.

Food banks

If you are at the point where you have no money for food you may be able to get help from a food bank. Start by looking online to see if there are any independent local food banks near you.

If you can’t find an independent food bank, you will need to get a referral from a professional such as a GP, social worker, teacher or charity worker to go to a recognised food bank, such as those run by The Trussell Trust.

If you’re not sure how to go about this, the best place to start is by calling the free Citizens Advice helpline on 0808 2082138 (open Monday to Friday, 9am-5pm). You will be able to talk in confidence to a trained Citizens Advice adviser about your situation. If needed, you will be given a food bank voucher so you can get an emergency food parcel.

Accidental savers

This group has received quite a bit of attention during lockdown, with talk of "enforced saving". We referred earlier to people being able to save money on the little extras of life. But also, for people who are still on full income but now working from home, there are various other potential savings to be made: for example commuting and other work-related costs such as lunches and clothes.

In theory, the money being saved could be put to good use, either to increase savings or to start paying off debt. But at Fair Finance, we understand that things are not quite so straightforward for a number of people. Many people who are now Accidental Savers have never before had money to spare. So rather than taking steps to use this money to help build their financial stability, they may view it as a temporary bonus that is likely to evaporate in the near future.

If you are in the position where you have never had savings before, it is easy to fall into the trap of thinking that you are just not good with money. But now is an opportunity to change that way of thinking and begin to save money towards your longer-term life goals, such as buying a home or re-training to change career.

There are two ways that you can make the most of being an Accidental Saver:

- Start by creating a family budget to work out how much money you have coming in and going out each month. Our article How to make a budget and stick to it can help here. You can then see how much money you could currently save each month.

- Open a separate savings account and set up a direct debit to put aside money each month. Treat it like any other bill for as long as you can afford to do so. Your savings will soon begin to build up, and you may also be able to top up your regular savings with little extras from time to time.

How Fair Finance can help

Fair Finance is committed to making financial services fairer, particularly for people who feel overlooked by the mainstream financial sector. We commissioned our work with Shift because we have been less able to engage fully with our clients during the pandemic due to the closure of our branches. We want to make sure that we still have a realistic understanding of where our clients are at, and how the pandemic is impacting not just their finances but their lives and wellbeing.

We are already incorporating many of the findings of the research outlined in this article to continually improve the ways we support our clients and their financial wellbeing. Some of the steps we are now taking are:

- Creating an online advice tool to enable people to access the best advice and support for their specific situation.

- Building a network of partnerships with other financial and support organisations to broaden the support we can offer to clients.

- Ensuring we collect the right data from clients to help us gain an in-depth understanding of their needs and provide the best support we can.

Whichever of the above three groups you most identify with, please get in touch with us at Fair Finance if you need financial advice or support during these difficult times. We will always do our best to make sure that you get a fair deal.